Source: coindesk.com

Flowty is a peer-to-peer NFT lending platform built on the Flow blockchain.

Flowty, a peer-to-peer non-fungible token (NFT) lending marketplace on the Flow blockchain, has raised $4.5 million in its first funding round, which was co-led by crypto investment firms Greenfield One and Lattice Capital.

The capital will be used for further platform development and building out the engineering and development team.

“We as a company are a technology platform that facilitates transactions between borrowers and lenders,” said Flowty co-founder Michael Levy in an interview with CoinDesk.

“Because it’s peer-to-peer, and because of how we set up our platform, we can provide our services to people without them needing to go through strict regulatory concepts,” explained Levy, adding:

“So our platform can be used by anyone – people who are traditionally unbankable, people who are in regions where they don’t have a robust financial system.”

Borrowers create a listing on the Flowty marketplace for their NFT and include the desired loan amount, rate and duration. Lenders choose what assets are attractive to them and deploy the capital, earning yield during the loan period and receiving the asset if the borrower defaults.

Flowty takes a fee from each loan that’s funded and essentially holds onto the asset until the loan duration is complete.

Flowty loans can be denominated in Flow blockchain stablecoins FUSD and tUSDT. The platform recently added support for Flow’s native FLOW token and the USDC stablecoin.

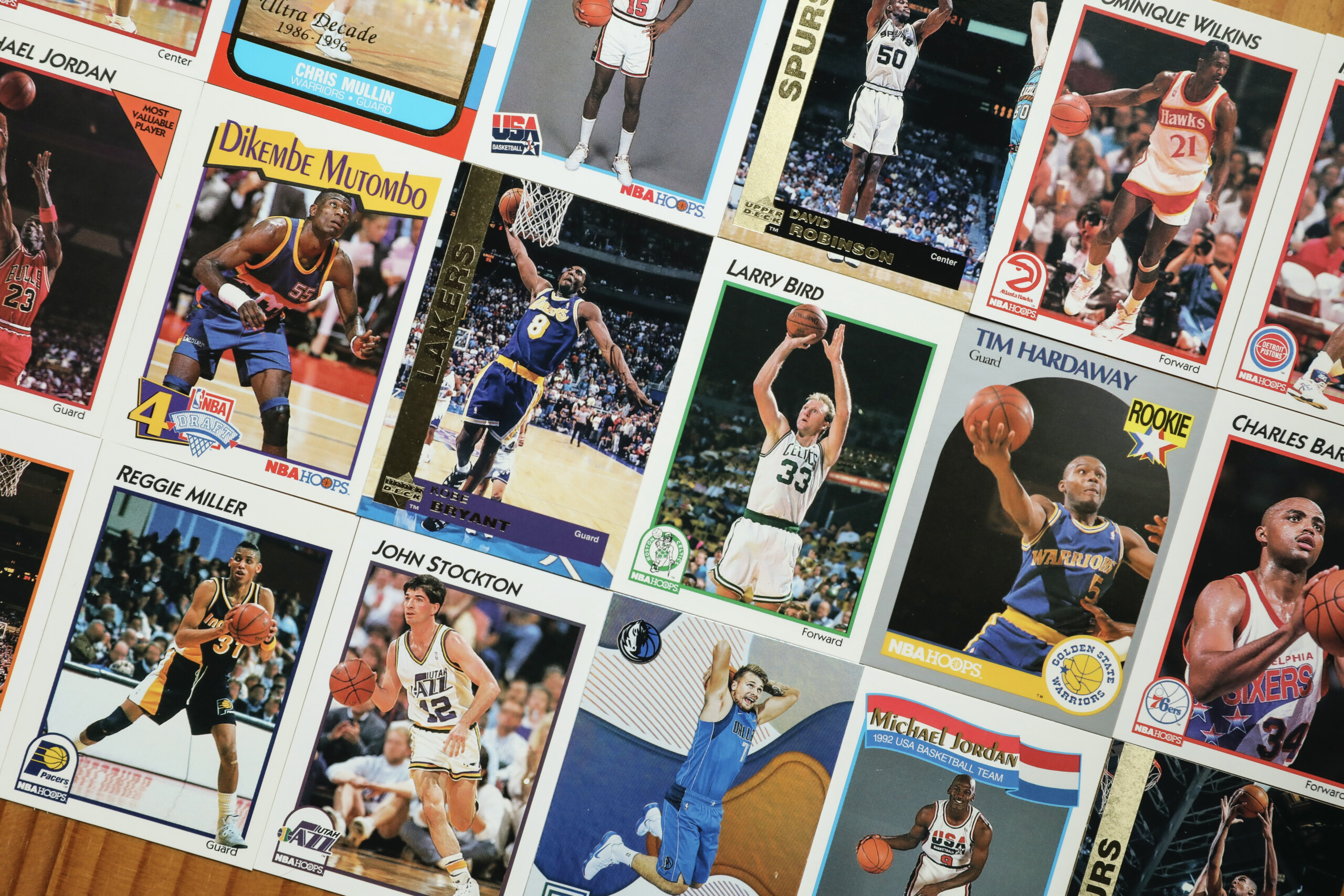

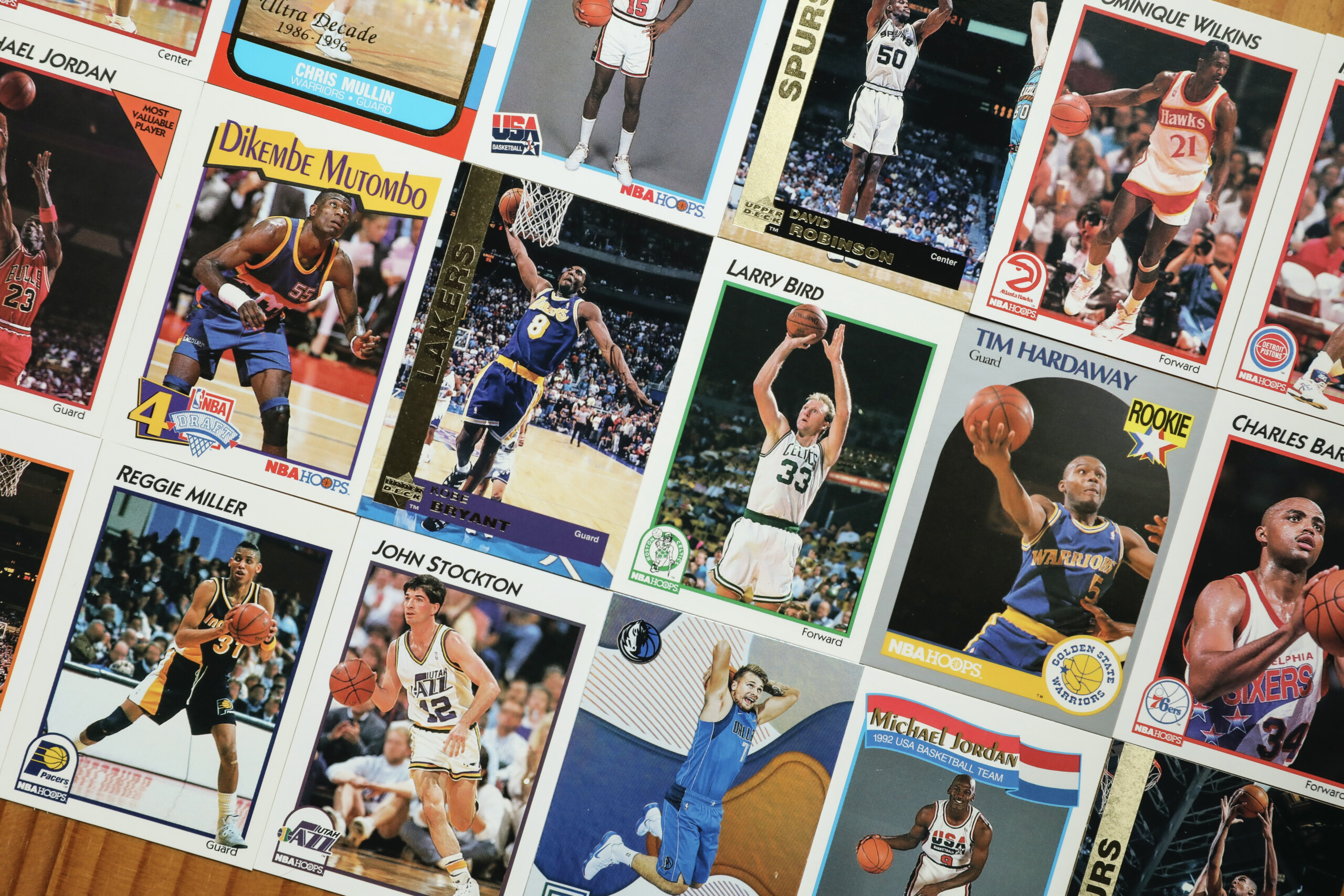

Top Shot whale

Levy came to crypto after a passion for sports memorabilia led to him being one of the first large investors in NBA Top Shot from Dapper Labs, which is also the creator of the Flow blockchain. Dapper was a participant in the Flowty funding round alongside Stermion, Tiny VC, Luno Expeditions and Red Beard Ventures.

“The peer-to-peer loan marketplace is the first core feature we built, but we’re working on a number of others,” Levy said. “Our more macro company vision is to be a kind of forefront to the financialization of NFTs.”