What Are DEXs?

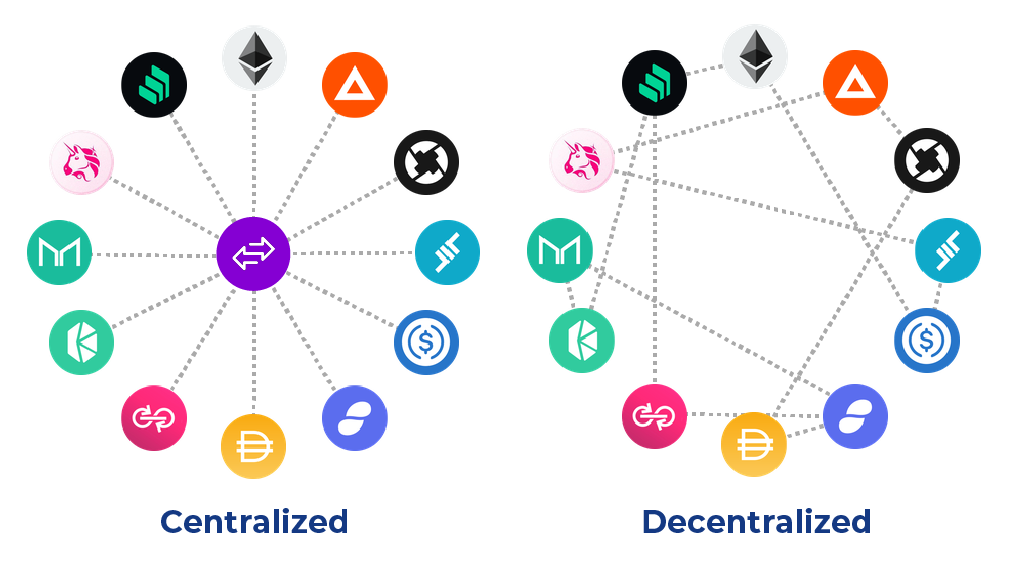

A decentralized exchange or DEX is a place where people can go to trade cryptocurrencies without an intermediary. To better identify what a decentralized exchange is, it’s important to first understand how centralized exchanges work.

DEX was created to eliminate the supervision of the authorities so that the transactions are accurate, transparent and trustless. DEX decentralized exchanges allow peer-to-peer (P2P) trading.

Before DeFi products became popular, DEXs were known to investors through Uniswap. This is an exchange that opens the door to a bright future for DEX.

CEX Vs. DEX: What’s The Difference?

Both the cryptocurrency exchanges have their own benefits and drawbacks. Moreover, traders can access any of the platform depending on their requirements. Let’s look at the key differences between CEX and DEX so that a trader can make an informed decision.

| Decentralized Exchange | Centralized Exchange |

| User controls funds | User controls funds |

| Anonymous | Not anonymous |

| Advanced tools | Less new features |

| Less prone to hacks | More prone to hacks |

| Low liquidity | Liquidity |

How Do DEXs Work?

In a typical centralized exchange, the asset in question is directly deposited — either in fiat (via bank transfer or credit/debit card) or in cryptocurrency. When cryptocurrencies are deposited, users lose control over them — although not from a usage standpoint, because of course cryptocurrencies can still be withdrawn and traded. However, control is lost from a technical standpoint: the cryptocurrency in question can no longer be spent on the blockchain.

Of course, this brings security risks: the team behind the crypto exchange could disappear along with the many crypto assets. A hack could also cause the assets to disappear. For many users, however, this is an acceptable risk, as they simply stick to reputable, well-known exchanges with a solid track record and precautions to prevent data breaches.

Decentralized exchanges are quite like their centralized counterparts in some respects but differ greatly in others. It is important to note that there are a few different types of decentralized exchanges. What they all have in common is that orders are executed on a blockchain (using smart contracts) and that users do not have to give up custody of their funds at any point.

There are a few variants to cross-blockchain DEXs, but the most popular variants revolve around assets on a single blockchain (like Ethereum or Binance Chain).

Decentralized Exchange (DEX): Pros & Cons

Pros

1. Privacy and Anonymity

Using a decentralized exchange typically only requires you to connect your wallet and sign a transaction. No identity verification process is required.

2. Security

Decentralized exchanges are generally more secure than centralized exchanges for two reasons:

- They are non-custodial: Hackers target exchanges to access the central database and extract users’ private keys and withdraw their funds. Since DEXs do not hold your private keys, hackers cannot get into your wallet.

- No identity checks: No risk of leaking private user data.

3. DeFi and NFT Integration

DeFi and NFTs are the two frontiers of the blockchain space, and DEXs are strong propellers. DEXs allows users to access the world of smart contracts and DApps that provide financial services, including lending and savings products, as well as NFT projects.

Cons

While decentralized trading venues provide some substantial advantages over centralized exchanges, they also have drawbacks new crypto investors need to be aware of.

1. Limited Trading

DEXs are currently limited in functionality. Features like margin trades, limit orders, futures, options, etc., are typically unavailable.

2. Efficiency

Decentralized exchanges are not as fast and efficient as CEXs due to the scalability issues faced by most blockchains. Centralized exchanges are not faced with this problem because they use both on-chain and off-chain mechanisms to ensure they run smoothly.

Top 5 Decentralized Exchanges (DEX) for 2022

Uniswap

On Ethereum, Uniswap is a decentralized system for automated liquidity provision.

Uniswap, one of the first automated market makers(AMM), allows users to act as liquidity providers by donating assets to decentralized liquidity pools. Liquidity providers earn a passive income by sharing a portion of the fees their pool produces.

Uniswap V3 has been released, which improves the capital efficiency, execution, and infrastructure of the Uniswap platform. Even though competing protocols with a similar interface have arisen to rival Uniswap, the Uniswap team has managed to keep their platform new for consumers by developing it.

PancakeSwap

PancakeSwap is an Automated Market Maker (AMM) and decentralized exchange for swapping BEP20 tokens on Binance Smart Chain.

PancakeSwap, like many of the other DEXs on our list, did not generate funds through an ICO or IDO. Instead, the PancakeSwap team directly bootstrapped it. Currently, the platform is funded by the PancakeSwap treasury, which receives a commission of 12 percent of all trading fees.

PancakeSwap offers a variety of yield farms, a Binance Coin prediction market, a lottery game, initial farm offerings, an NFT market, and more in addition to its DEX capabilities.

SushiSwap

SushiSwap is an automated market-making (AMM) decentralized exchange (DEX) currently on the Ethereum blockchain. SushiSwap is also non-custodial, which means that—unlike centralized exchanges—SushiSwap does not need to possess your tokens in order for you to be able to trade them. Instead, SushiSwap allows users to trade trustlessly, peer-to-peer, with liquidity that is supplied by other users.

The platform was one of the first DExs to launch on the Avalanche, Fantom, Harmony, and Celo blockchains, and has earned a reputation for being one of the first DExs to launch on new chains.

SushiSwap, as an automated market maker, allows users to earn money by contributing liquidity to the site. It also has a range of other features, such as a variety of yield pools, an on-chain lending solution, and a MISO launchpad.

Mdex

MDEX is a decentralized platform for cross-chain transactions and deployed on BSC, HECO and Ethereum. MDEX aims to integrate the advantages of multiple chains to build a high-performance compound DEX ecology. The dual mining mechanism of liquidity mining and transaction mining provides participants with maximum rewards. MDEX is now available on Heco and BSC, and users can use MDEX Bridge to complete cross-chain transactions on Heco, Ethereum, and BSC.

Despite the fact that gas taxes on the Ethereum blockchain will be reduced soon, MDEX has managed to surpass Uniswap in terms of market cap volume when both MDEX and MDEX (BSC) market cap volumes are considered. MDEX isn’t bashful about claiming to be the world’s largest DeFi ecosystem.

MDEX should be on your radar if you’re looking for a decentralized exchange. Its user-friendliness and the services it provides have fueled remarkable growth for any decentralized exchange.

JustSwap

JustSwap is the first decentralized token exchange protocol on the TRON platform, allowing users to exchange any TRC20 tokens at the system price instantly.

JustSwap also allows users to earn transaction fees by being a liquidity provider, even getting commission-free on the protocol. In addition to exchanging TRC20 tokens, JustSwap users have the ability to earn transaction fees and mining rewards.

Conclusion

In general, DEX and CEX both have certain advantages and limitations. CEX has high trading volume and liquidity. At the same time, the platform also allows users to convert from Fiat to Crypto and vice versa. Meanwhile, DEXs are durable “protected” against attack and fraud from third parties.

Through the above article, HotQA believes that you have made the right choice for yourself. Good luck with your future investment projects.

Disclaimer: This is not financial advice. This article is for informational and sharing purposes only.