What is Ref Finance?

Ref Finance is a community-governed decentralized financial platform built on the Near Protocol with the purpose of building a wide range of protocols. Ref Finance also offers a variety of basic services, including a decentralized trading platform swap, farming, and staking through the use of the AMM mechanism.

Being built on Near Protocol, Ref Finance inherits the power of optimizing the platform with a transaction cost of less than 0.01 USD and transaction speeds of 1-2 seconds, attracting a large number of community members to assist. This decentralized platform is gaining traction and is a valuable addition to the multi-chain ecosystem. Ref’s product development is not limited to DEX; in the future, the company plans to incorporate Launchpad and Dao to further improve its offerings.

What is Ref Finance’s potential?

Swapping: Ref Finance’s smartcontract has the function of managing multiple pools providing automatic trading. For example, if you want to swap BTC/USDC pair but currently only BTC/USDT and USDT/USDC pairs are available, then you just need to choose BTC/USDC swap pair. Then the protocol automatically implements the swap.

Farming: Liquidity Provider will receive REFas a reward in Farming.

Staking: Holders can stake REF to earn more REF with specific APR and share profits at the same time.

Developers can receive a fee from dApp development on Ref Finance’s AMM protocol.

Ref Finance is governed by Ref Finance Sputnik DAO. Tokens will be divided among liquidity providers, users and developers.

The project is audited by Jita. However, Ref Finance will also look for a second Audit after the first Audit is completed.

Information about REF token

Benefits of holding REF token

REF is a utility token and is used in decentralized governance. Specifically, REF will be used in operations such as:

- Pay transaction fees: Users will have to pay transaction fees in REF tokens. Profits from transaction fee collection will be partially re-shared to the holders.

- Reward: REF will be used as a reward to incentivize LPs to provide liquidity to the protocol.

- Governance: Holders REF can participate in pre-voting project development proposals such as voting on transaction fees, token burn, project development costs, etc.

Token metrics

- Token Name: Ref Finance

- Ticker: REF

- Blockchain: Near

- Token Standard: NEP-141

- Contract: (v2.ref-financial.near)

- Token Type: Utility, Governance

- Total Supply: 100,000,000

- Circulating Supply: 4,130,000

Token allocation

With the goal of becoming a decentralized project, the community will play a leading role in project governance. For that reason, the project has allocated a large number of tokens specifically for incentivizing users to provide liquidity, similar to their protocol.

- Liquidity Incentive: 60%

- Treasury: 35%

- Airdrops: 5%

Token release schedule

- Liquidity Incentive – Used to reward liquidity providers. In order to limit inflation, the project has designed a bonus payment mechanism that is gradually reduced year by year as follows:

- 25% in the first year

- 18.3% in the second year

- 11.67% in the third year

- 5% in the fourth year

- Treasury – The treasury is specifically used for the following purposes:

- Community development activities: 20% – Not yet announced

- Developer fund: 10% – Pay equally in 4 years

- Token sale on Skyward: 2.5% – Pay in 1 week according to Skyward’s selling mechanism

- Liquidity Supply: 2.5% – Unlock 100% TGE

- Airdrop

- Airdrop for early users (Retroactive): 3% – Lock 3 months then release in 3 months

- Strategic Airdrop: 2% – Not yet announced

Note: Tokenomics can be changed if approved by the community through voting by DAO members.

How to own REF token?

Users can trade REF tokens on MEXC, Gate.io, BingX, Ref Finance.

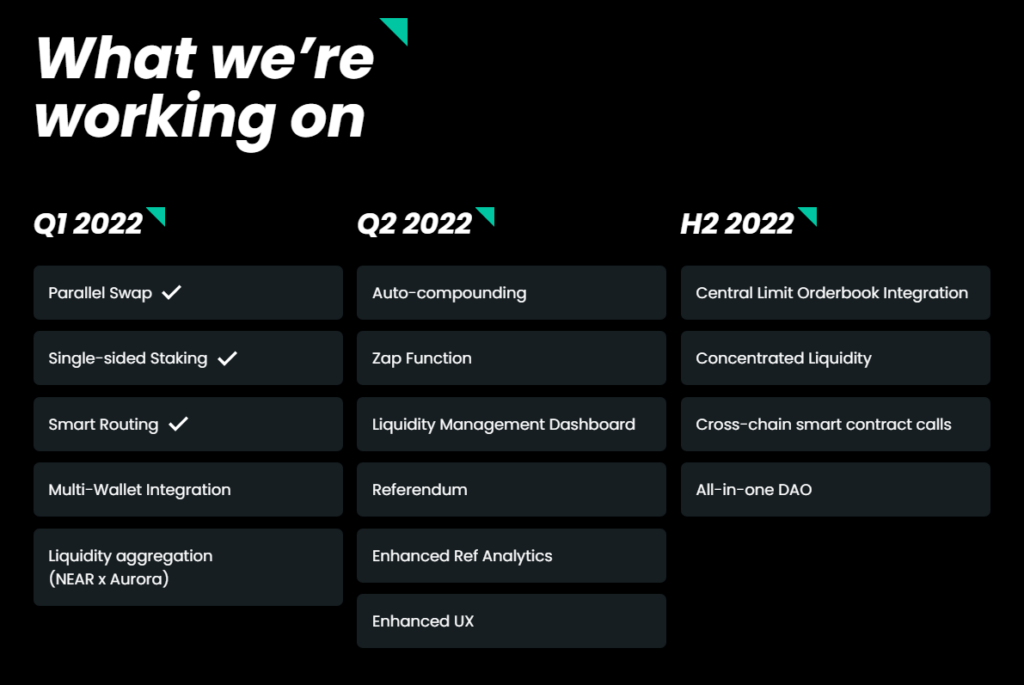

Roadmap

- Q1/2022

- Parallel Swap – Done

- Single-sided Staking

- Smart Routing

- Integrated multi-wallet

- Q2/2022

- Auto-compounding

- Zap Function

- Liquidity Management Dashboard

- Referendum

- Enhanced Ref Analytics

- Enhanced UX

- H2/2022

- Update order book function

- Concentrated Liquidity

- Launch cross-chain smart contract

Investors and Backers

As one of the projects in the investment portfolio of Alameda Research, Ref Finance is also invested by other funds such as: Jump Crypto, DragonFly Capital, OKX Blockchain Capital, Kucoin Venture,…

Partnership

Ref Finance’s partners are popular projects with a large number of users in the Near ecosystem such as Near, Octopus Network, Burrow, Paras, Skyward Finance…

Disclaimer: This is not financial advice. This article is for informational and sharing purposes only.