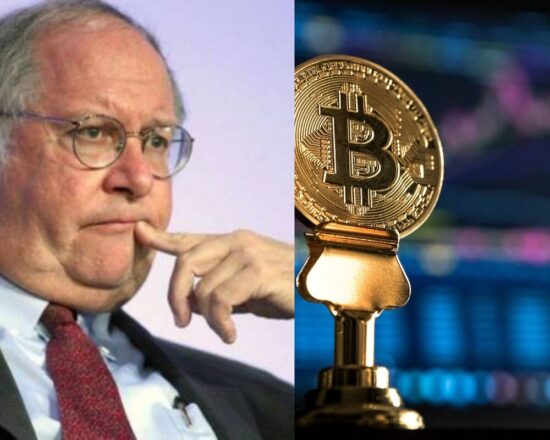

Star fund manager Bill Miller says ‘bitcoin is the only economic entity where supply isn’t affected by demand.’

Legendary investor Bill Miller showed some big love for cryptocurrency as the billionaire and fund manager said that bitcoin and other cryptos now represent around 50% of his personal assets.

Miller made his revelation during a video interview with WealthTrack, saying that he views bitcoin as “insurance” against financial catastrophes and government overreach.

He said he invested in bitcoin in 2014, and then started buying it up again last spring during a surge in interest by venture capital firms.

“Bitcoin is the only economic entity where supply isn’t affected by demand,” he said.

The billionaire investor advised individual investors to put at least 1% of their assets in bitcoin.

“I think the average investor should ask himself or herself what do you have in your portfolio that has that kind of track record — number one; is very, very underpenetrated; can provide a service of insurance against financial catastrophe that no one else can provide; and can go up ten times or fifty times,” Miller said. “The answer is: nothing.”

He explained that “if you put 1% of your portfolio in it for diversification, even if it goes to zero, which I think is highly improbable, but of course possible, you can always afford to lose 1%.”

Miller is founder and chief investment officer of Miller Value Partners, a company he founded back in 1999 while working at Legg Mason. He lost most of his fortune in the late 2000s, but made a remarkable comeback thanks to his investment in Amazon (AMZN) – Get Amazon.com, Inc. Report and bitcoin.

“I thought 50% is a good stopping point for me,” he said, “but if it goes all the way to $80-85k, I’ll buy it all the way down.”

He holds the record for beating the S&P 500 index for 15 consecutive years in the years 1991 to 2005.